The Imitations

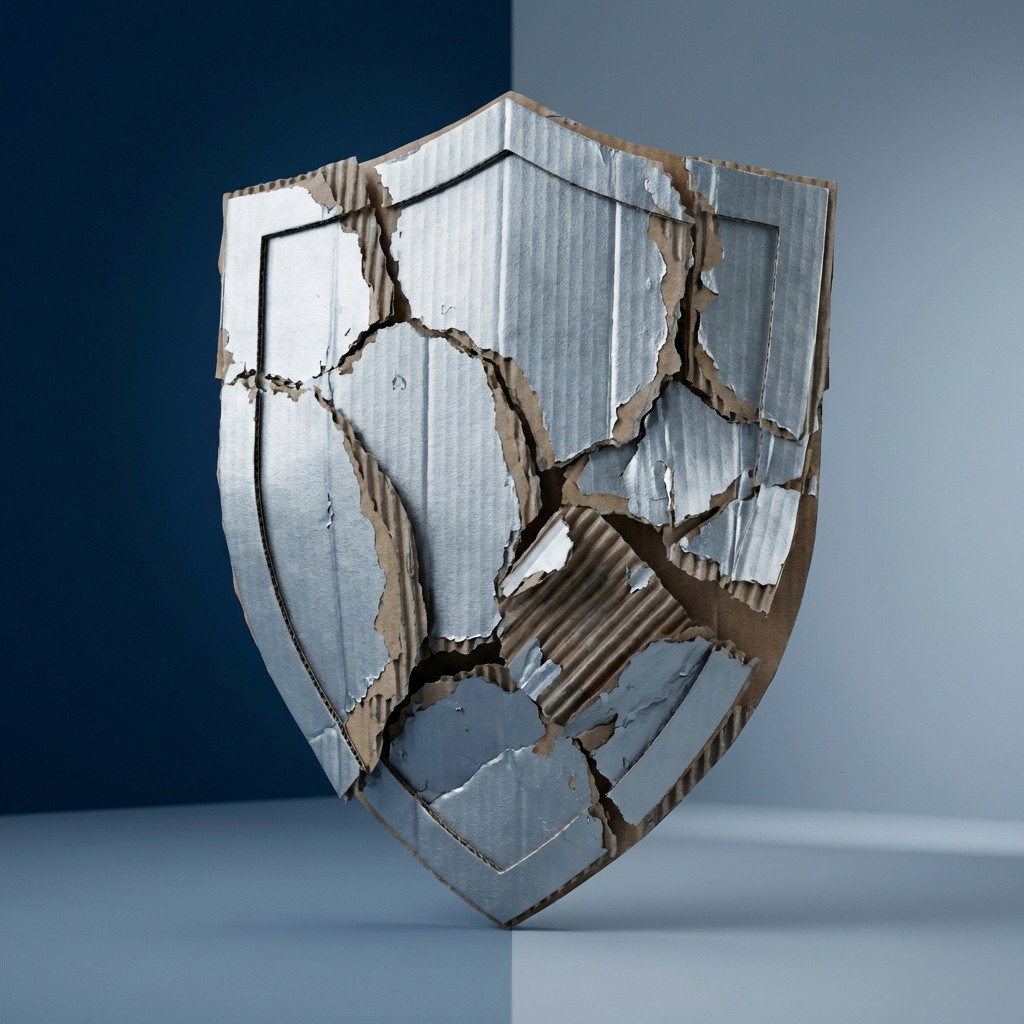

Why the 'alternatives' are designed to fail.

We must address the 'alternative' plans often proposed. These are not healthcare plans; they are financial products designed to fail.

The 'Tax Credit' Mirage

AKA: 'Here is a coupon for your premium.'

"Instead of sending money to insurers, we will send a fixed payment to you, so you can buy the coverage you want."

**A flat credit does not change what care costs, it just changes who gets stuck holding the gap. Insurance is not the surgery.** Insurance is the yearly contract that has three separate price tags: the premium, the deductible, and the out of pocket maximum. A fixed $5,000 can disappear into the premium alone, and you can still be on the hook for thousands more before coverage meaningfully helps. For a family, it is often not even close. Worse, a flat credit is a subsidy with no price discipline. If hospitals, drug makers, and consolidated health systems can still set high prices, the insurance premium simply adjusts upward and eats the credit. You end up with the same market, the same pricing power, and a government coupon that quietly becomes part of the premium math. And yes, this is the current Trump style proposal being pitched again as “money directly to the people,” after years of “a plan is coming” talk and vague frameworks rather than a full cost restructuring.

High Risk Pools

AKA: 'The Leper Colony'

"We protect the sick by putting them in special High Risk Pools so premiums stay low for everyone else."

**This is segregation.** By putting all the sick people in one pool, that pool becomes impossibly expensive. In states that tried this, premiums for the 'risk pool' hit $30,000 a year. It is a way to look like you are covering pre-existing conditions while actually pricing the sick out of existence.

Selling Across State Lines

AKA: 'The Race to the Bottom'

"Buying insurance should be like buying a car. Let insurers compete across state lines!"

**It sounds good, but in practice, it means every insurer moves to the state with the weakest consumer protection laws (like South Dakota for credit cards). You will end up buying a 'cheap' plan from a state that allows insurers to deny everything.** It destroys your state's ability to protect its own citizens.

Obamacare

AKA: 'Mandate to Subsidize the Mess'

"Expand coverage. Protect preexisting conditions. Make insurance 'affordable' with subsidies. Keep your doctor."

**Obamacare tried to patch the insurance layer while leaving the real cost engines largely intact.** Hospital pricing power stayed intact. Drug and device pricing stayed intact. Facility fees and hospital-owned billing tricks stayed intact. Malpractice pressure and defensive medicine stayed intact. Medical education costs and the incentives that push clinicians away from primary care stayed intact. Administrative complexity and the billing maze stayed intact. It mandated participation and subsidized the product, but it did not restructure the market that sets the prices or the incentives that make prices climb. When you subsidize a high-cost system without simultaneously forcing the cost drivers to change, you do not control costs. You socialize the overpayment. Premiums and deductibles become a government-assisted pipeline into the same expensive structure. It did expand coverage. But it also normalized the idea that the fix is “more subsidies” instead of “lower underlying prices, fewer middlemen tolls, and disciplined rules on the major cost drivers.” It made millions of working people the shock absorbers for a system they cannot negotiate with and cannot escape.

Association Health Plans

AKA: 'The Junk Plan Escape Hatch'

"Let small businesses and self employed people band together and buy cheaper insurance."

**The price drop comes from stripping benefits and skirting rules.** These plans cherry pick healthier groups and dump everyone else back into the regulated market, which raises premiums there. When people actually get sick, they learn the plan is cheap because it does not cover the thing they bought it for.

HSAs and High Deductibles

AKA: 'Paying Cash for a House Fire'

"Give people health savings accounts so they become smarter shoppers."

**You can compare prices for shampoo.** You cannot “shop around” while having a stroke. The real costs come from catastrophic events and long, complicated diseases. HSAs mostly act like a tax break for higher earners. High deductibles mostly act like a barrier to care for everyone else. People skip meds, delay visits, and then show up sicker and far more expensive to treat.