"Same money. Smarter channel. No more guessing games with premiums and surprise bills."

Americans do not hate paying for health care. They hate paying for health care like this.

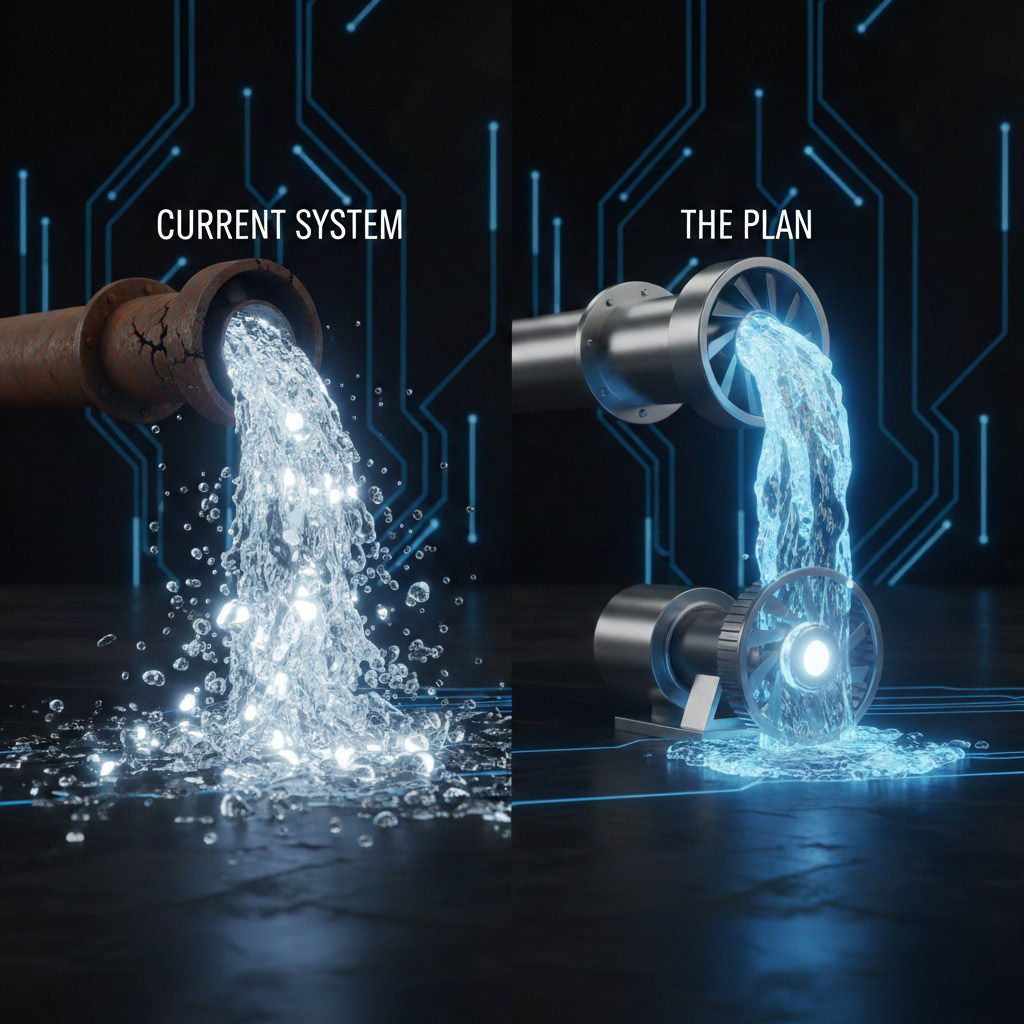

Right now money flows through a maze. Employers pay unpredictable premiums. Workers see part of that cost shaved off their wages. Families pay deductibles, copays and coinsurance that nobody can predict. Some years are quiet. One bad year wipes out savings.

The SAFECARE Plan replaces that chaos with a clear rule set. We call it the Payroll Swap.

For Employers

Instead of private premiums, employers pay a simple national health contribution. For example an eight percent share of payroll. Most businesses already pay the equivalent of twelve to twenty percent of payroll once you add premiums and administration. For them this is a cut in cost and a cut in headaches.

For Individuals

For most workers it feels like Medicare. A 3.5% base contribution is applied to personal Modified Adjusted Gross Income and collected automatically through wage withholding, then reconciled on the annual tax return. Other income is handled through estimated payments and reconciliation. Self-employed workers pay 11.5% on net earnings from self-employment in place of the employer employee split. A personal high-income surtax applies per individual, not by household, at 1.0% above 100,000 dollars, an additional 1.5% above 250,000 dollars, and an additional 2.0% above 500,000 dollars, reaching an 8.0% marginal rate above 500,000 dollars.

The base is designed to be predictable and to avoid hidden penalties. Social Security benefits, VA-administered veterans benefits, and up to 100,000 dollars of retirement distributions are excluded from the contribution base. The small business 199A qualified business income deduction is preserved. The Medicare Hospital Insurance payroll tax is replaced for covered income, and the Net Investment Income Tax is repealed on the main implementation date, so investment income is not hit twice.

Coverage: At the Point of Service

The rules are simple. Members under age 18 and members with individual Modified Adjusted Gross Income below 200 percent of the Federal poverty level (for a single individual) pay nothing at the point of service for essential care. Other adults pay small, predictable fixed copays for certain non emergency services. Copays stop once you hit the hard annual cap of 750 dollars per person per year (2026 dollars), indexed over time. After the cap is reached, the Plan pays one hundred percent of covered essential services for the rest of the year.

The cap is per person, not per household. Two people who marry do not get punished by a double limit. This avoids the hidden marriage penalty that exists in some current programs.

Behind the Scenes

The system claims back the money we now waste. Every clinic no longer needs a small army of billing staff to fight twenty different insurers. Coding games and denial wars shrink. Insurer overhead and profit margins are reduced.

Summary: Bottom Line

The country already spends enough money to cover everyone. We just send it through a shredder first. Fair financing is about changing the plumbing, not about asking people to pour endless new water into a leaking system.