The 80/20 Suicide Pact: Why Your Insurer Loves Inflation

The Affordable Care Act's 'Medical Loss Ratio' was sold as a cap on greed, but it actually incentivized insurers to supercharge healthcare inflation.

The Issue

The 80/20 Rule: A License to Steal 🔒

Let us begin with a definition, because the insurance industry relies on the fact that you have a job and a life, and therefore do not have time to read federal registers. They bank on your boredom.

The Medical Loss Ratio (MLR), popularized by the Affordable Care Act, is often marketed as a "profit cap." The law mandates that insurance companies must spend at least 80% (or 85% for large groups) of the premiums they collect on actual "medical care." They are only allowed to keep the remaining 20% for administration, marketing, salaries, and profit.

On the surface, this sounds noble. It sounds like a leash.

It is not a leash. It is a perverse incentive structure designed by people who understand math to trap people who trust slogans.

Think about it like a sniper. If you are a CEO, and the law says you can only keep 20 cents of every dollar you touch, how do you satisfy your shareholders? You cannot simply raise your margin to 30%—that is illegal. You cannot simply cut costs—because if you reduce medical spending, your allowed profit slice shrinks with it.

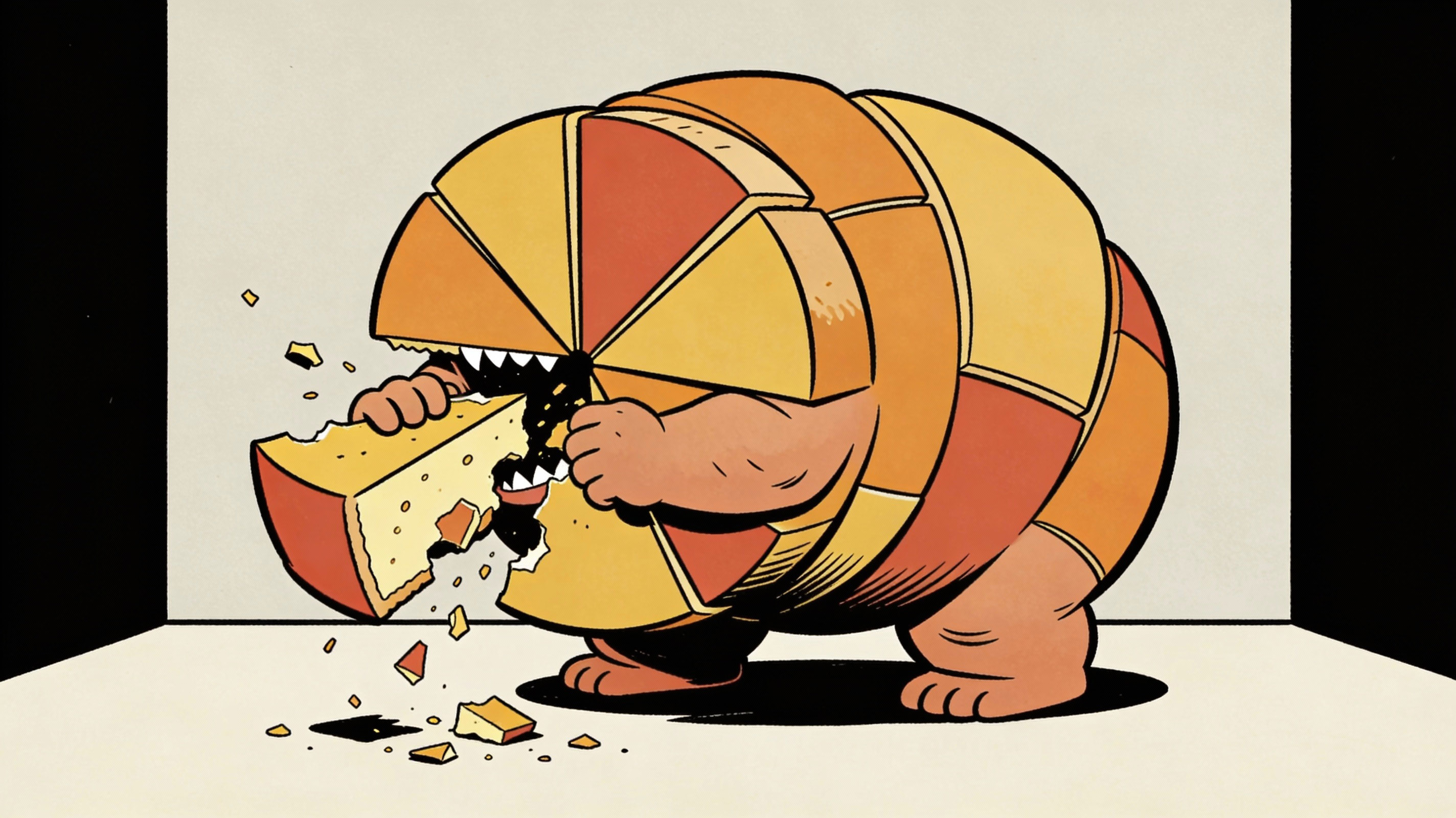

The only way to grow your profit is to make the total pie bigger.

If healthcare costs $1,000, you are allowed to keep $200. But if healthcare costs $2,000, you are allowed to keep $400. Suddenly, the insurance company—the entity theoretically designed to protect you from high prices—has a mathematical addiction to inflation. They need hospitals to charge more. They need drug prices to skyrocket. Because 20% of a bloated, dying system is worth a lot more than 20% of a lean, efficient one.

The Vertical Integration Shell Game 🏗️

It gets worse. The industry realized that if they are capped on the insurance side, they should simply buy the medical side.

This is why your insurer is buying physician groups, pharmacy benefit managers, and clinics. If UnitedHealthcare pays Optum (which it owns) for a service, that counts as "medical spending" for the MLR. The money moves from the insurer's left pocket (capped) to the provider's right pocket (uncapped).

They are paying themselves with your money, checking a box that says "Medical Care," and keeping the profit anyway. It is a money laundering operation with better branding.

The Trap: By capping the percentage of profit rather than the amount, we turned the guardians of the treasury into the looters.

The Fix

The SAFECARE Solution: Total Decoupling ✅

We do not try to patch this leaking boat with more complex ratios. You cannot regulate a tumor into being healthy; you have to excise it. The SAFECARE Act does not rely on "incentives" to control costs. It relies on the law of gravity.

1. Abolishing the Middleman Under Section 1004, we sunset duplicative private plans. The entity that profited from inflation is removed from the equation. There is no 20% skim anymore because there is no private premium to skim from.

2. Direct Rate Setting Instead of passively accepting high prices to boost a profit margin, the SAFECARE Plan uses Section 402 to set payment rates based on the actual cost of efficient delivery. We pay providers fairly—100% of Medicare rates or higher—but we stop paying the "inflation tax" required to feed the insurance bureaucracy.

3. Blocking the Double-Dip Section 105 explicitly prohibits private insurers from selling coverage that duplicates the essential health services provided by the Plan. They cannot sell you what you already own. This stops the "Vertical Integration" game cold, because the massive flow of premium dollars that fueled the acquisition of physician practices dries up.

4. Global Budgets for Stability For rural and safety-net hospitals, we move to Global Budgets under Section 402(d). We pay them to be open and ready, decoupling their survival from the volume of services they churn out. This removes the incentive to overtreat just to keep the lights on.

SAFECARE doesn't ask insurers to be nicer. It makes their business model illegal.

Criticism & Rebuttal

"Competition Lowers Prices"

Critics will scream that we are destroying the "free market" competition that lowers prices.

The Reality: There is no competition on price in the current system. The 80/20 rule ensured that all insurers benefited from rising prices in lockstep. You do not have a free market; you have a hostage negotiation where the hostage negotiator takes a 20% cut of the ransom. SAFECARE restores market power to the buyer (the public) through Section 405 (negotiation).

"Government Inefficiency"

People worry that the government is inherently wasteful and will bloat costs even worse than the private sector.

The Reality: This is empirically false. Medicare's administrative overhead is consistently around 2%, compared to the 12-18% overhead of private insurers. Furthermore, Section 804 mandates the use of AI and advanced analytics to mercilessly hunt down fraud and waste, and Section 207(f) imposes a hard cap on cost growth tied to GDP.

Transition Shock

We must be honest: eliminating the private insurance industry will cause job losses in the administrative sector. The 80/20 rule created an army of paper-pushers whose entire job is to move money around.

The Mitigation: While SAFECARE focuses on healthcare, the savings (approx. $500 billion/year in administrative waste alone) provide ample fiscal space. We cannot keep paying people to dig holes and fill them up just to keep unemployment down. The transition is phased over several years to allow the economy to adapt.

References

- The ACA Rule That Accidentally Made Higher Health Care Costs Profitable - MoneyGeek

- The Unintended Consequences Of The ACA's Medical Loss Ratio Requirement - RAND Corporation

- UnitedHealthcare pays more to its own physician practices than others, study finds - Brown University / STAT News

- Medical Loss Ratio Reform Can Help Curb Corporate Power and Lower Health Care Costs - Center for American Progress

- Gaming the Medical Loss Ratio: How health insurers turn consumer protections into corporate windfalls - FREOPP

- Reports show health insurers skirt medical loss ratio rules - Association of Health Care Journalists

- Medical Loss Ratio's Role in the Large Group Insurer Market - American Journal of Managed Care

- Vertical Integration in Healthcare: The POP Act Analysis - Frier Levitt Law